One common phrase you hear is that we help stores incentivize whatever is important to them. But often, the answer to that question is not so simple.

What is important for your store?

The best way to attack a question so open-ended is to look at data and statistics. Calculating your store’s Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) are great steps you can take to finding the answer to that daunting question.

In this blog post, we’ll focus on how exactly you can make these calculations to uncover what’s important to your store’s success.

A Look at Customer Acquisition Costs

An eCommerce company selling organic food spent $50,000 on advertising last month and in return gained 1000 new customers; this makes for a Customer Acquisition Cost (CAC) of $50 per customer.

Is this good? Or bad? Average maybe? Or way too high?

How can you know for sure?

Unsurprisingly, the answer can vary from store to store based on industry, target market, and other factors. To find out what goals to set for your store, you’ll need to dive a little deeper and figure out how much a typical new customer spends during their first month with you.

If we figure out that this average customer spends $150 (Average Order Value – AOV) during their first month and that our gross profit margin is ~25%, that leaves us with taking home $37.5 on that $150 purchase.

Now, subtracting our $50 CAC (acquisition cost) from that, we arrive at a grand total of -$12.5.

With that $50,000 spent on advertising bringing in 1000 new customers, we ended up losing $12,500. Not good. In fact, this likely makes for an entirely unsustainable business.

In eCommerce, the goal is to always inspire loyalty and to make sure that the customers you have already acquired stick around and keep making purchases. Having dependable customer loyalty can help stores overcome even the largest profit vs. acquisition deficits.

Put simply, the more purchases customers make, the more money we will be making off of them. Since the CAC does not change, the additional spend directly increases profit vs. acquisition margins.

Looking back at our $50 CAC model, let’s see how exactly taking multiple purchases into account changes our prior calculations on the feasibility of our $50 acquisition cost.

The difference can be obvious as early as with a customer’s second purchase. The same customer who was making negative $12.5 on their first purchase for us is netting a $25 profit on the next one. And it doesn’t stop there. Our potential for profit keeps growing as the same customer makes more and more purchases.

The profit (or loss) that changes with every purchase over a customer’s lifetime, that number is known as Customer Lifetime Value (CLV) and it’s one of the most important and useful concepts in sales. Developing a focus on CLV guides merchants to shift their attention from short-term monetary gains into the longevity and quality of their customer relationships.

So how exactly can you make sure your store generates the right metrics to help you maximize your CLV?

Lets first take a look at what exactly CLV can tell you about your customers and your store.

What Exactly is CLV?

Customer Lifetime Value (CLV or often CLTV), is a data-backed prediction of the net profit of the entire future relationship you would build with a customer.

Because we don’t know how long each relationship will be, we make an estimate and state CLV as a periodic value. As in “This customer’s 12-month (or 24 months or any other time period really) CLV is $X.”

This enables us to make better decisions both in the short and long term. The more valuable your customers are, the more you can invest in marketing, better service, and newer products.

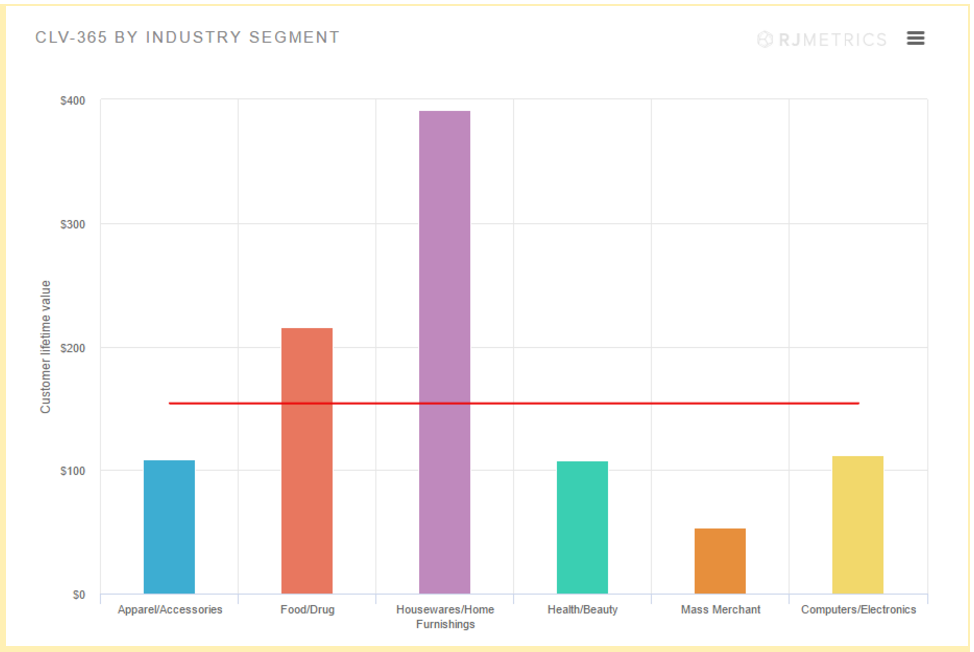

CLV is highly variable across different verticals. Take a look at differing values that customers generate during their first year of business by industry:

One year CLV in Apparel is just slightly above $100, while Housewares has one just shy of $400. This reflects directly on how much money we can invest in acquiring and servicing these customers during that first year of business.

Calculating Customer Lifetime Value

There are many different ways and models to calculate CLV. The simplest ones include the number of purchases made per customer per year, spend per purchase and your gross margin. More in-depth analyses add customer retention rate, marketing cost, customer service cost, discount rate and more.

The more inputs a given model uses, the more accurate and useful it is. More sophisticated CLV calculations are also notoriously time-consuming and expensive.

We’ll focus on the simplest model first, which assumes customer lifetime value is the result of two buyer behaviors:

- How many orders a customer makes in a given time period

- How much a customer spends per order

Add to that your gross profit margin and you have your first rudimentary CLV value. Before we get into projection models, let’s take a look at historical CLV, which is the only absolute CLV we can evaluate.

How to Calculate CLV for Ecommerce

Historical CLVs

Take all your previous customers’ data (# of orders + spend per order) and you get a CLV. To help break down your historical CLV, divide by time passed since the person first became a customer. This provides you with an accurate interpretation of your old customers’ spending habits.

Here’s an example of arriving at a Historical CLV using the Average Revenue Per User Model (average revenue per user) model.

We’ll need to know the average revenue per customer per month (total revenue ÷ number of months since the customer joined), add them up, and then multiply by 12 for 1-year CLV, 24 for 2-year CLV and so on.

Suppose today is January 1, 2021. We have Mark and Mary as our two example customers. Mark made his first purchase in January 2019 and Mary in March 2020. This is what their purchase history looks like:

Mark started buying in January 2019 and his average monthly revenue since then is ($80 + $40 + $55 +$20 + $70)/24 = $11.04. Divided by 24 because Mark joined 24 months ago.

For Mary, her average monthly revenue from joining is ($100 + $200 + $150 + $300)/10 = $75. 10 because he joined 10 months ago.

Taken together we arrive at an average monthly revenue for those two customers of ($11.04 + $75)/2 = $43.02. To find a 12-month CLV we simply multiply that by the # of months (12) and arrive at $516.24 1-year CLV.

The benefit of the ARPU approach is that it’s relatively easy to calculate.

The big drawback?

This number can be wildly misleading if you are drawing from a small sample size of previous customers or groups of customers with vastly different spending habits. If we just calculate 1-year CLV separately for both Mark and Mary, the difference is massive:

Mark’s 1-year CLV would be $11.04 x 12 months = $132.48, while Mary’s is $75 x 12 months = $900.

A slight improvement over the ARPU approach is to use cohort analysis. It calculates ARPU per month per cohort, instead of average per user.

A cohort, in this case, is all customers who made their first purchase in a particular month. It recognizes that not all customer months are the same and gives a nice overview of variation across the lifetime of a customer.

While this approach gives us a clearer picture of CLV, it can still be misleading as it does not account for the timing (as in the year) of when a customer made their first purchase.

Those differences could very well result in changing CLVs. Similarly, if you plan to take a different approach in the future, or your customer base begins to shift, prior CLVs may no longer accurately predict future CLV. At least some of the discrepancy between customer spending habits can be explained by the time of first purchase (if it’s far apart), the launch of a new product line, or perhaps an alternative advertising approach.

Each variant could have brought you customers with different characteristics and behaviors than your previous ones.

Historical CLV is a generally versatile statistic, but as we discussed, its not without its downfalls.

A More Detailed Approach

To get CLV numbers that are actually usable and useful in driving important business decisions about sales, marketing, product development, customer support, and more, a historical CLV may not be the best statistic to study.

While it’s useful in some instances, it is not as useful for forecasting, which is crucial to setting yourself up for future success. Instead, you should be looking into more recent data to delve deeper into it.

All of your customers are different. They have different spending habits; they come to you from different sources and have seen different advertisements. All of this and more play a role in their relationship with you.

Beyond a general CLV, break your customers into segments based on things like acquisition medium, source, and channel and calculate CLV based on that. By looking at individual CLV by acquisition channel, you can do a better job of assessing whether you should spend more or less on that channel.

Many eCommerce companies invest time and money into lowering their new customer acquisition cost by optimizing and minimizing PPC costs, going for the cheapest Facebook targeting, not investing in long-tail strategies like blogging, video, or educational content. Don’t do that.

By focusing only on the price of acquiring, and not in the long term value that those customers produce, you could be missing out on hundreds of thousands of dollars of extra revenue.

Just look at the example below, the cheapest channel per customer (Facebook) ends up making the least money, and the channel with the highest acquiring costs, Influencers, makes the most money. This is the power of knowing, understanding, and using Customer Lifetime Value in action.

*Profit as in Revenue – (# of customers x CAC)

Now What?

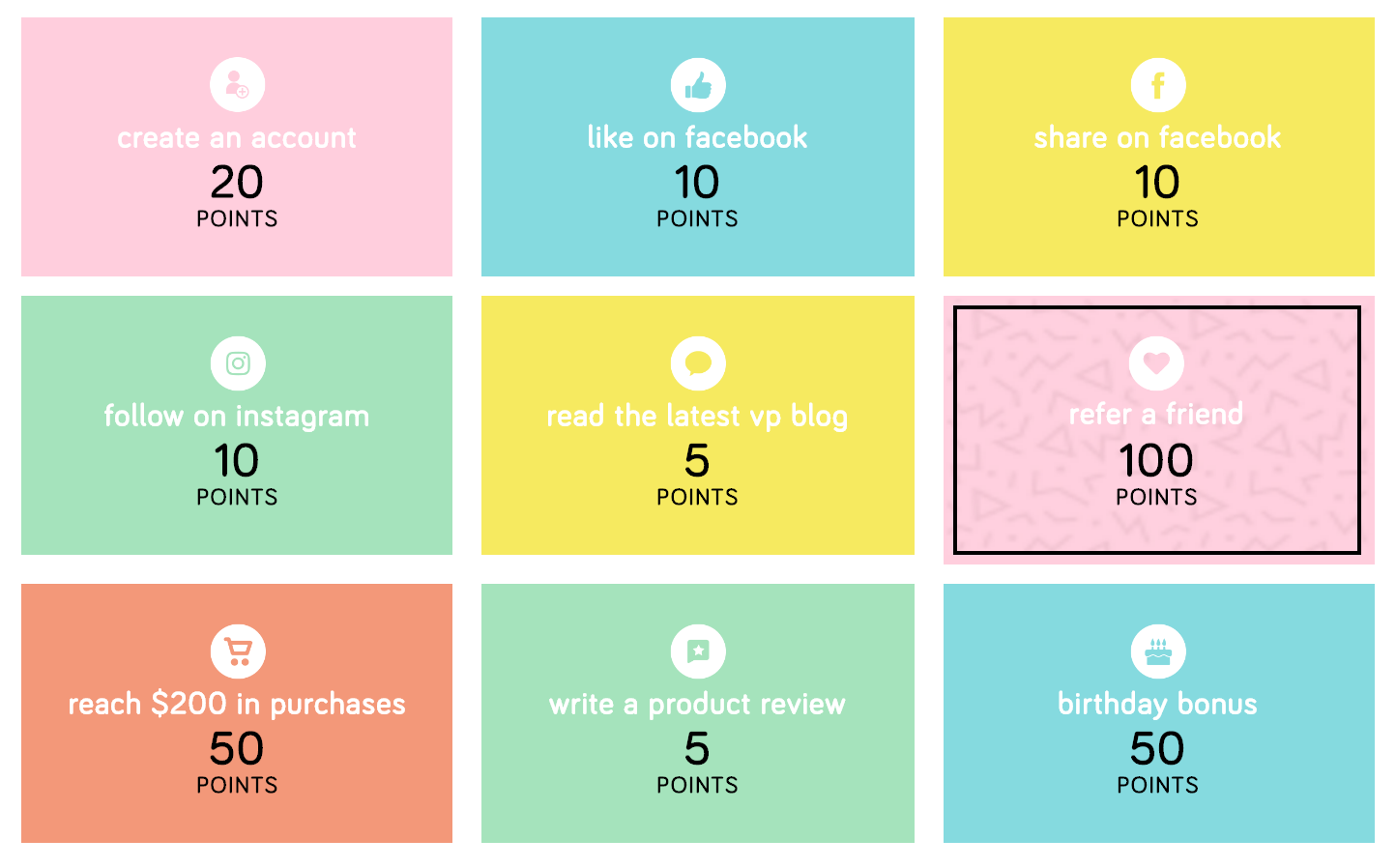

This strategy helps you determine what is important to your store, which is where incentive marketing comes in. For example, you might determine that customers who have viewed a certain piece of content eventually have a higher CLV than your average customers. With a rewards program, you can reward those customers points for reading that piece of content and becoming higher CLV customers.

A detailed CLV analysis likely reveals several channels or completed campaigns that are most profitable to take advantage of the knowledge you’ve gained. Now that you know which types of customers generate more profit for your store, synthesize more of them. Incentivize your customers to write a review on your page, or to share content on Facebook, or to follow your on twitter.

Gathering data and calculating your Customer Acquisition Costs as well as segmented Customer Lifetime Values will help you answer all important questions of which customers are most valuable to your store. Once you have the answer to that, incentive marketing can take you to the next level.