3-Day Rolling Payouts

OrderCircle has a 3 day rollout policy for payments. This means that you would receive payment for items sold by your wholesale shoe store directly into your bank account in 3 days. OrderCircle charges only 3% fee on payments received for wholesale shoe items sold by your B2B ecommerce store. Rest of the payment is transferred to your bank account without any hidden charges or monthly fees.

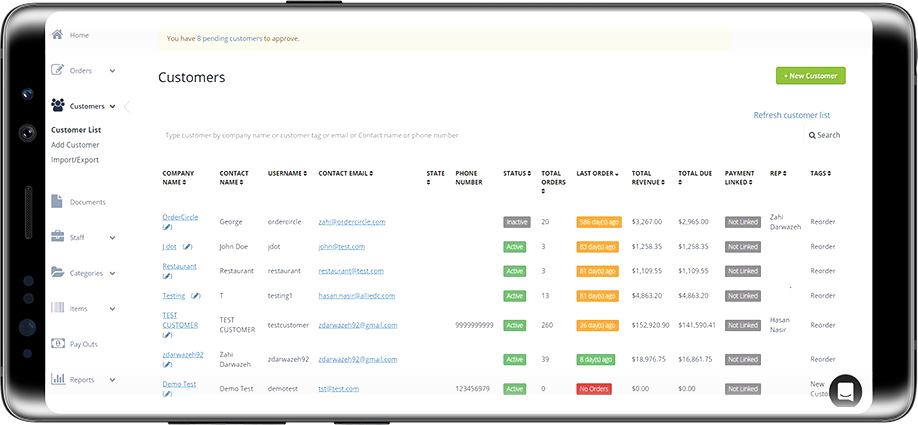

Set Different Payment Terms for Each Customer

OrderCircle’s robust platform enables you to configure different payment terms for customers as per your discretion. This customization allows you to list same items with different price tags for different customers.

You can also set variable policies such as 100% upfront payment for wholesale shoe orders or order now and pay later on your B2B ecommerce store. You can charge your wholesale customers automatically when payment is due or charge their card manually as per agreed terms via your B2B ecommerce portal.

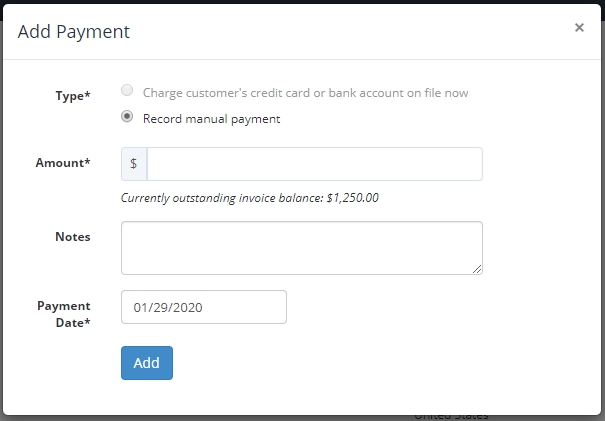

Record Manual Payments

OrderCircle enables you to record wholesale payments for shoe orders manually for customers that pay via cheque. This feature also facilitates cash on delivery wholesale payments for orders placed on your B2B ecommerce store. All your payment records are stored in our secure database so your account stays organized and up to date at all times.

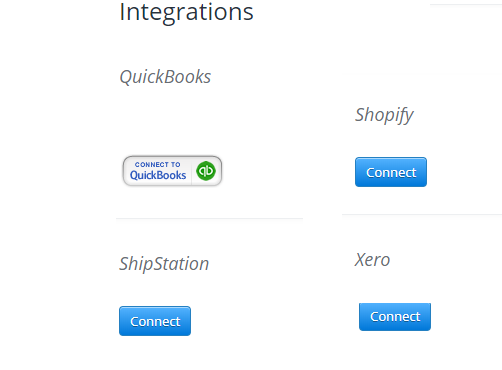

3rd Party Payment Processing Integrations

OrderCircle doesn’t lock you into a restricted payment gateway; rather it offers a one size fits all solution. We enable your wholesale B2B ecommerce platform to choose from additional transaction options and allow integration with best-established payment processors if you have an existing relationship you want to maintain. Our 3rd party payment processors currently consist of Authorize.net, PayPal, PayFlow Pro and QuickBooks Payments.

Get Started