LIFO Inventory Valuation

Hasan Nasir

What is inventory valuation, and why is it important?

Inventory valuation is the act of assigning a monetary value to the inventory on the balance sheet. Also, it is a critical component to calculate the cost of goods sold by the company, which ultimately determines its profitability and tax outflow.

The three widely used inventory valuation methods include LIFO (Last In, First Out), FIFO (First In, First Out), and WAC (Weighted Average Cost).

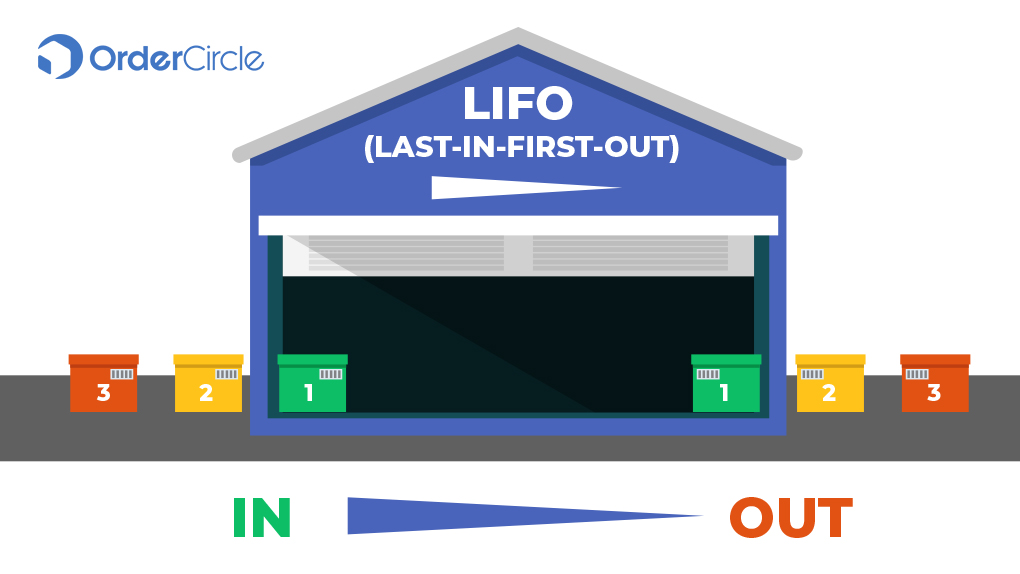

Definition of LIFO

‘LIFO’ stands for Last In, First Out. It is an inventory valuation method, wherein inventory purchased in the most recent times is recorded as sold first, while the older inventory is counted in the year-end inventory.

Thus, if LIFO is the inventory valuation method, the cost of the old inventory remains on the balance sheet, while the cost of the newest inventory is recognized in the profit & loss statement.

When is LIFO used?

LIFO inventory valuation method is primarily used during inflationary times i.e. the price of goods (inventory) purchased is on a rising trend and thereby the most recently purchased goods are the costliest. Thus, by using LIFO, the cost of goods sold will have the highest cost price, which would in-turn decrease their profits on books and result in lower taxable income.

Any inventory valuation method is used only for cost accounting purposes. Physically, the company can sell the oldest piece of inventory first.

Other inventory valuation methods

FIFO: First In First Out, or FIFO, is the opposite of LIFO. Thus, under the FIFO inventory valuation method, the oldest inventory is recorded as sold, first while the newest inventory stays on the balance sheet.

WAC: Weighted Average Cost, or WAC, takes into account the average price of the total goods. Here, the total cost of goods available for sale is divided by the total number of goods available for sale, and the per-unit cost of a good is arrived at. Goods available for sale include opening inventory + purchases during the year.

Example of LIFO inventory valuation method

A shoe manufacturing company, where products are manufactured across two seasons during the year. The cost of production and quantity manufactured in each phase are as below:

| Season | Pair of Shoes manufactured | Cost of production (Rs/unit) | Total cost of production(Rs.) |

| Winter | 100 | 10 | 1000 |

| Summer | 100 | 15 | 1500 |

| Total | 200 | – | 2500 |

Now, the company sells 150 pairs of shoes during the year, out of the 200 pairs manufactured. The company uses LIFO accounting. Thus, for accounting purposes, the company has first sold the most recent manufactured shoes. Thus, 100 items of Summer manufacturing and 50 items of Winter manufacturing would be sold, as follows:

| Season | Pair of Shoes manufactured | Cost of production (Rs/unit) | Total cost of production(Rs.) |

| Cost of goods sold | |||

| Summer | 100 | 15 | 1500 |

| Winter | 50 | 10 | 500 |

| Total cost | 150 | 2000 | |

| Inventory on balance sheet | |||

| Winter | 50 | 10 | 500 |

| Total inventory | 50 | – | 500 |

Thus, the company’s cost of goods sold (to be accounted for in profit and loss) would be Rs.2000, while the cost of the remaining 50 units from the Winter manufacturing (Rs.10 each) will reflect in the balance sheet next year, as opening inventory.

Conclusion

LIFO inventory valuation method expenses the latest inventory first. LIFO is less used since the inventory value gets distorted at the end of the accounting term. This is because the oldest inventory (cost-wise) stays on the balance sheet. LIFO is used only when companies intend to reduce their taxable income. Thus, this method has been banned by the IFRS and is presently used only in the US. In practice, FIFO is a relatively widely accepted inventory valuation method.