Cost of Goods Sold

Hasan Nasir

Cost: A critical term that determines the profitability of a business. Thus, one always aims to minimize the cost. For this, it is essential to understand various components of cost in a business.

Cost of Goods Sold, or COGS is one such cost component. Let us understand it in detail.

What is the Cost of Goods Sold?

Cost of goods sold, or COGS, is also known as ‘Cost of Sales.’ As the name suggests, COGS is the cost of producing goods a company sells. It includes all the direct costs a company incurs for producing such goods. These are costs of raw materials, labor, packing, transportation, etc.

COGS does not include the indirect costs of a business. The indirect costs are those which cannot be directly attributed to the production. These include administration costs, interest, depreciation, and selling expenses.

How to calculate the Cost of Goods Sold?

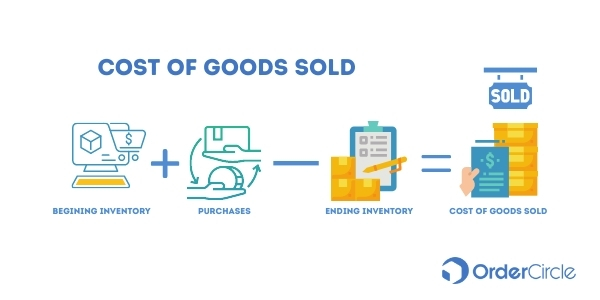

COGS is calculated using the following formula:

COGS = Opening Inventory + Purchases – Closing inventory

Every business, in anticipation of demand, produces goods. Not all of it is sold during the year; hence some goods remain at the year-end. These are referred to as ‘Closing Inventory’ of that year. These goods are available for sale in the next year. Hence, they become the ‘Opening Inventory’ of the following year. This apart, a business also produces/purchases goods during the year to meet demand.

The cost of goods sold is the summation of all direct costs associated with these three components.

Let us understand this by an example:

Say Sam is a chocolate manufacturer. He uses a financial year to record the accounting entries of his business. Thus, he records the closing inventory on March 31st every year. This becomes the opening inventory on April 1st of the next financial year.

Now let us assume that the cost of his opening inventory was USD 10,000. But this might not suffice to meet the demand for the entire year. Thus, Sam purchased additional inventory worth USD 5,000 during the year. At the end of the year, some inventory remained in his business. He calculated the value of this remaining inventory at USD 3,000. This is the closing inventory of this business.

Now, let us find the Cost of Goods Sold for the business of Sam, for this year:

COGS = Opening Inventory + Purchases made during the year – Closing Inventory

= USD (15,000 + 5,000 – 3,000)

= USD 17,000

Calculation of COGS involves the valuation of inventory. Various methods can do this. Three primary methods are FIFO (First In, First Out), LIFO (Last In, First Out), and WAC (Weighted Average Cost).

COGS is calculated for producing only those goods which we sell during the year. Some goods remain unsold at the year-end. These are termed as closing inventory and are available for sale next year. Hence, we exclude the value of closing inventory for the calculation of the COGS.

Also, COGS is applicable for companies that manufacture products. Companies that provide only services do not calculate COGS. Instead, they calculate the Cost of Services.

Accounting of the Cost of Goods Sold:

A seller records the COGS in the profit & loss statement of his business. He records the same as an expense. He deducts the COGS from his revenue to calculate the profitability of his business.

Direct costs are included in the calculation of COGS. However, to calculate the final profitability, he also deducts other indirect costs.

The closing inventory is recorded in the balance sheet. It is included in the current assets. It is an asset which a business uses the following year.

Significance of COGS in a business:

As discussed earlier, COGS determines the profitability of a business. It involves direct costs of production. Thus, it indicates the gross profit of the business. It shows how well a company manages its costs of production. This includes terms with the raw material suppliers and labor management.

COGS also indicates the efficiency of the cost structure of a business. Say, for example, a business earns a healthy gross profit. However, it makes a meager net profit. What can be the reason for the same? The reason is that the business has a low cost of production. But its indirect costs are high. The company spends more on costs not directly related to production. This results in a high gross profit but a low net profit.

Thus, a seller may compare the COGS to the total cost of his business. This will indicate the proportion of direct and indirect costs in the business. By doing so, he can analyze which costs are higher and take steps to reduce them.

A seller also gets an idea about his market position through COGS. He can compare the COGS of his business to that of the peers. If his COGS is significantly higher than the peers, his cost structure is less efficient. He needs to renegotiate the terms of his raw material supply. He also needs to reduce other costs of production, such as labor and transportation.

Thus, COGS guides a seller in improving the profitability of his business.