FIFO Inventory Valuation

Hasan Nasir

What is inventory valuation, and why is it important?

Inventory valuation is to assign a monetary value to the inventory. Based on this, a company records costs against its sales and calculates its year-end stock. This helps determine its profits and tax outflow.

There are various inventory valuation methods. The three major ones are FIFO (First In, First Out), LIFO (Last In, First Out), and WAC (Weighted Average Cost).

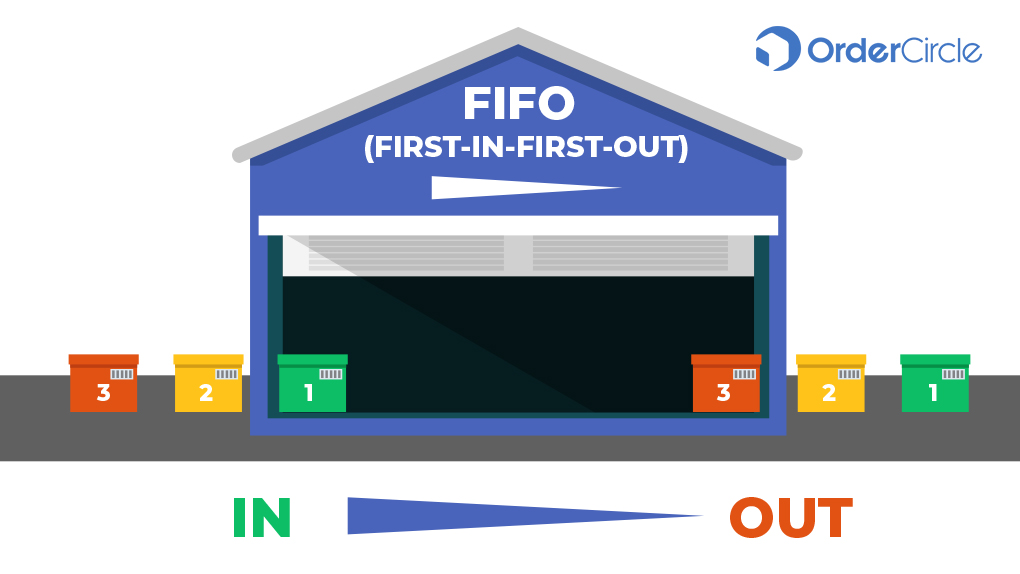

What is FIFO?

‘FIFO’ stands for First In, First Out. In FIFO, a company assumes that goods produced first are sold first. Goods produced the last stay as inventory in the books. Thus, the cost of older goods is recorded against sales. The cost of the latest goods remains on the balance sheet.

The valuation method is only for accounting purposes. Physically, a company can sell the latest inventory first. FIFO is the most used inventory valuation method. Under this, the old inventory is recorded as sold first. This inventory is lower in cost than the latest inventory. Thus, companies report higher profits under FIFO.

Advantages of FIFO:

- FIFO is an easy-to-understand and widely used method.

- Old inventory is sold first. Old cost is recorded first. Thus, accounting becomes easier. Chances of mistakes are also lower.

- Goods produced in more recent times stay as inventory on the balance sheet. This gives a more accurate idea of the market value of these goods.

- Old low-cost inventory is recorded as sold first. Thus, higher profit is reflected in the accounts. This makes the business attractive to investors.

- Manipulation of accounts becomes difficult under FIFO due to its simplicity.

Disadvantages of FIFO:

- Higher tax payout due to higher profits.

Other inventory valuation methods

Apart from FIFO, there are a few other inventory valuation methods. These are as follows:

LIFO: Last-In, First-Out, or LIFO, is the opposite of FIFO. Under LIFO, the latest inventory is recorded as sold first. The oldest inventory stays on the balance sheet. This method reduces the profits of the company. Thus, tax payout is also lower.

WAC: Weighted Average Cost, or WAC, considers the average price of goods. Here, the cost of goods available for sale is divided by goods available for sale. With this, a per-unit cost of a good is arrived at.

Goods available for sale = opening inventory + purchases

Example of FIFO inventory valuation method

A shoe manufacturing company, where products are manufactured across two seasons during the year. The cost of production and quantity manufactured in each phase are as below:

| Season | Pair of Shoes manufactured | Cost of production (Rs. / unit) | Total cost of production(Rs.) |

| Winter | 100 | 10 | 1000 |

| Summer | 100 | 15 | 1500 |

| Total | 200 | – | 2500 |

The company sells 150 pair of shoes during the year, out of the 200 pairs manufactured. It decides to use FIFO for accounting. Hence, it assumes that it has sold the oldest manufactured shoes first. Thus, it sells 100 items of winter manufacturing and 50 items of summer manufacturing.

| Season | Pair of Shoes Manufactured | Cost of production (Rs. / unit) | Total cost of production (Rs.) |

| Cost of goods sold | |||

| Winter | 100 | 10 | 1000 |

| Summer | 50 | 15 | 750 |

| Total cost | 150 | 1750 | |

| Inventory on the balance sheet | |||

| Summer | 50 | 15 | 750 |

| Total inventory | 50 | – | 750 |

As shown above, the company records a cost of Rs.1750 against sales. The cost of Rs.750 is recorded as inventory on the balance sheet (from items of Summer manufacturing).

Conclusion

Inventory valuation affects the booked costs and profits of a company. Thus, a company should choose a method suited to its business and follow it consistently. There are several inventory valuation methods including FIFO, LIFO, and WAC. Out of this, FIFO is the most used method.